us germany tax treaty social security

It helps many people who without the agreement would not be eligible for monthly retirement disability or survivors benefits under the Social Security system of one or both countries. Income tax purposes as if they were paid under the social security legislation of the United States.

Social Security Taxes Expatrio Com

The United States - Germany Tax Treaty also covers corporation taxation stating that A separate agreement called a Totalization Agreement helps ensure that us expats in Germany dont pay social security taxes to both governments while their contributions made while in Germany can be credited.

. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. Does the US Have a Tax Treaty with Germany. Since 2005 pensioners living abroad who draw retirement income from Germany within the meaning of 22 No.

In August 1991 a tax treaty was finalized which exempted residents of Germany from the nonresident alien tax withholding. In addition the Convention will provide for exemption of German residents from United States tax on United States Social Security benefits. Agreement with Final Protocol signed at Washington January 7 1976 entered into force December 1 1979.

The reporting requirements for claiming tax treaty benefits on Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701b are not discussed. Residents are regarded for US. The exemption was effective for benefits paid after December 31 1989 for areas which were formerly in West Germany.

7 of the German Income Tax Act. Social security income. Were living in Germany so US Social Security wages are nontaxable treaty article192.

Should they be excluded when calculating the gross income for Form 1116. 19 2 DTC USA. Yesthe US has a formal tax treaty with Germany.

1 Sentence 3a of the German Income Tax Act have generally been subject to limited income tax liability 49 Sec. This means that if you are still living in Germany when you qualify for social security benefits you will not pay any US. In terms of input foreign social security benefits are fundamentally treated as pension for US tax purposes.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. If a person is assigned to work within Germany for 5 years or fewer by a United States company they will pay taxes into the United States Social Security system. Tax purposes as if they were paid under.

And if you have moved back to the US. An agreement effective December 1 1979 between the United States and Germany improves Social Security protection for people who work or have worked in both countries. The German Social Security benefits received are reported on your US tax return in the section for reporting US Social Security benefits.

Germany - Tax Treaty Documents. Business profit taxation under the Germany-US double tax treaty. To claim a provision in the United States Germany Tax Treaty other than claiming US tax credits expats should use IRS form 8833.

DC plan Netherlands beneficial ownership is determined. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. There is an agreement between Germany and the United States regarding which country receives social security taxes when a person is working within Germany.

Therefor US social security pension of US citizens living in Germany will only be taxed in Germany. In all cases see the treaty for details and conditions. The Germany-US double taxation agreement establishes the manner in which business profits derived by German or US companies are taxed in the other country.

The treaty provides that the distributions are taxed only in your country of residence. Inheritance Gift And Wealth Taxes. The complete texts of the following tax treaty documents are available in Adobe PDF format.

It was effective for benefits paid after December 31 1990 for areas which were formerly in. The purpose of the treaty is to provide clarity for certain tax rules impacting citizens and residents of either country on matters involving cross-border income. The US also has a totalization agreement with Germany which clarifies whether an American living abroad should contribute to the German or US social security system.

The United States has tax treaties with Germany and Canada whereby Social Security benefits paid over those countries to US residents are. The US-Germany Totalization Agreement A separate agreement called a Totalization Agreement helps ensure that us expats in Germany dont pay social security taxes to both governments while their contributions made. While the US Germany Tax treaty is not the final word on how items of income will be taxed it does help Taxpayers better understand how either the US Government andor Germany will tax certain sources of income.

Germany imposes a tax upon the transfer of property by inheritance or by gift. You may therefore enter them on Line 4 or Line 5. These benefits will not be taxed in the US.

For retirement the treaty also results in your German social security payments being taxed the same way as US. The Convention further provides both States with the flexibility to deal with hybrid financial instruments that have both debt and equity features. US-German Social Security Agreement.

The United States and Germany entered into a bilateral international income tax treaty several years ago. My preference in this case would be to use Line 5 ie. Yes if you did not pay tax on this income in Germany then this would be excluded from the income that was taxed by your foreign country of residence.

Residents are treated for US. The tax treaty serves to benefit citizens and residents from Germany who reside in the United States and vice-versa. For purposes of the US-Germany tax treaty the municipal business tax is treated like an income tax.

As amended by a Supplementary Agreement signed at Washington October 2 1986 entered into force March 1 1988 and by a Second Supplementary Agreement signed at Bonn March 6 1995 entered into force May 1 1996. Federal income tax treatments for social security benefits from France and Germany are very different. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty.

This article uses the current United StatesCanada income tax treaty text posted by Canadas Department of Finance. A special provision applies for pensions and other similar remunerations paid by the government public subdivisions or local authorities in respect to services rendered to one of these official bodies Art. The rate of tax is graduated and varies with the nature of the relationship between the transferor and the transferee.

The United States has tax treaties with Germany and Canada whereby Social Security benefits paid by those countries to US. In the Federal Republic of Germany this will include. The agreement establishes that companies will only be taxed in the country the company is registered in unless the company has a permanent.

Under income tax treaties with Canada and Germany social security benefits paid by those countries to US. This US-Germany tax treaty helps US expats avoid double taxation while living in Germany.

Even If You Are Still Young And Have A Long Career Ahead Of You You Should Not Neglect To Consider The Instagram Apps How To Find Out Buy Instagram Followers

Irs Form 6166 Certification Of U S Tax Residency

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Social Security Totalization Agreements

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Dual Citizen Needing Us Tax Help Here S A Guide

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

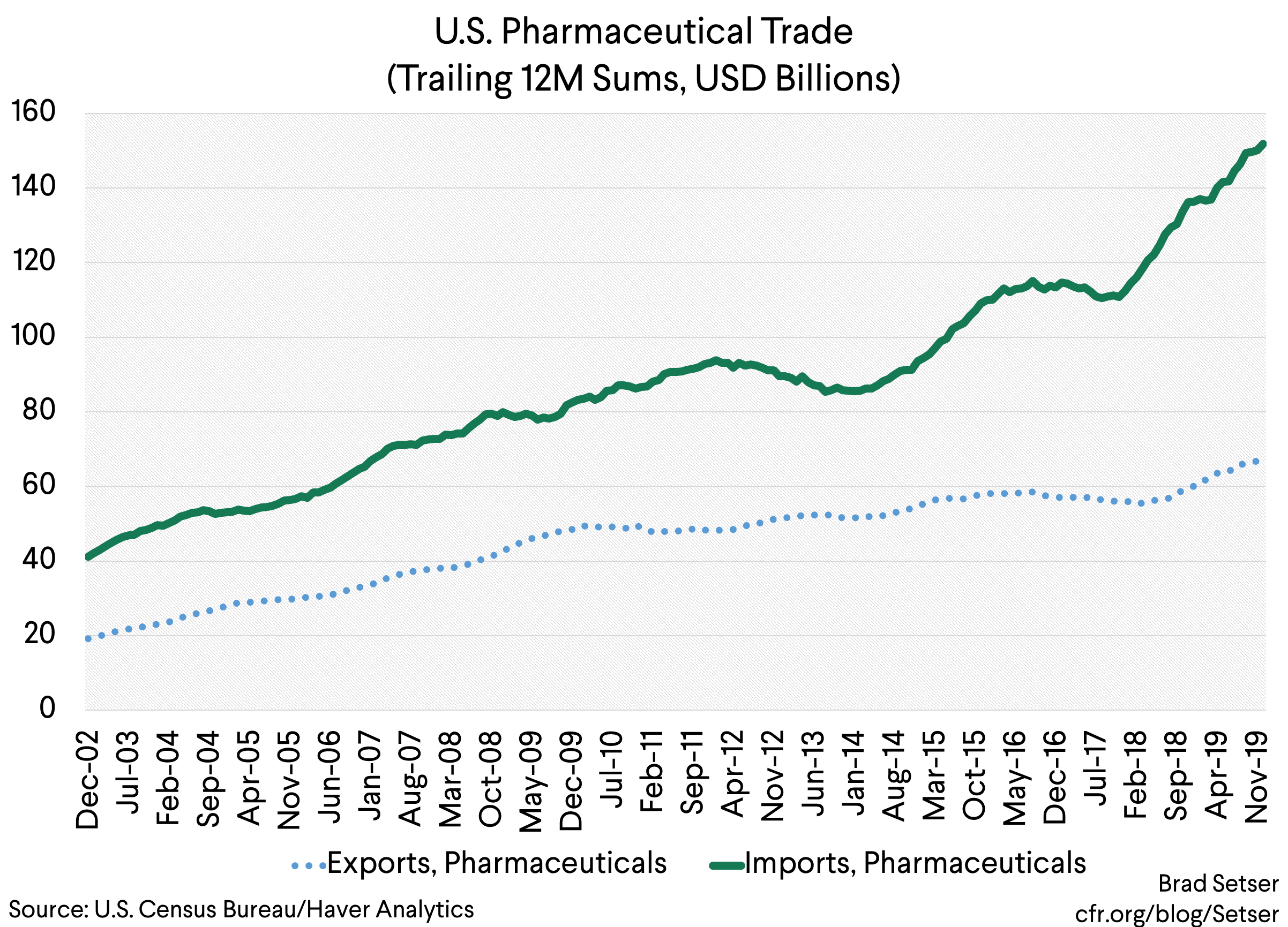

Tax Games Big Pharma Versus Big Tech Council On Foreign Relations

Avoiding Double Taxation In Germany A Guide For Uk Expats Expat Focus Filing Taxes Tax Time Tax Season

What Small Business Owners Should Know About Social Security Taxes

Should The United States Terminate Its Tax Treaty With Russia

How Do Taxes Affect Income Inequality Tax Policy Center

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Do Us Expats Have To Pay Social Security Tax Us Tax Help

Do Expats Get Social Security Greenback Expat Tax Services